Executive Summary

The Problem

- Storing and retrieving paper signature cards was time consuming and expensive

The Solution

- Go paperless with 8 million account openings/year

The Results

- Customer adoption is at 90%

- Better customer experience - less time waiting for the teller to go back-and-forth to the printer

- Branches spend less time on paperwork, more time generating revenue

- No need for storage space for new signature cards

- No need to keep heavier card stock on-hand in the branch

- Branches instantly access electronic signature cards

- Compliant electronic process with full audit trail

- Integration with OneSpan took just days

Today 90% of customers choose e-signatures over paper when opening a new deposit account or managing an existing account, such as filing a change of address or adding a new signer to the account. Electronic signing has also had a positive effect on business customers. Often business people are in different states, and opening accounts with multiple co-signers is now facilitated by the electronic process.

Freeing bankers and tellers from the time-consuming paper process has been beneficial as well. Bank personnel are still spending the same amount of time face-to-face with the customer, only now the majority of that time is spent capturing the customer’s preferences and offering them additional value.

The Problem

Time spent managing paper contributes nothing to revenue. Bankers and tellers were devoting precious time to create signature cards, retrieve them from storage, photocopy and fax them to other branches, and return to the archives to re-file them. Sometimes this would be compounded by problems with misplaced or worn cards where the signature was not legible. Plus, the archiving space needed for this vast inventory of signature cards was a growing problem. The back rooms used for storage were often bigger than the public front-end of the branch.

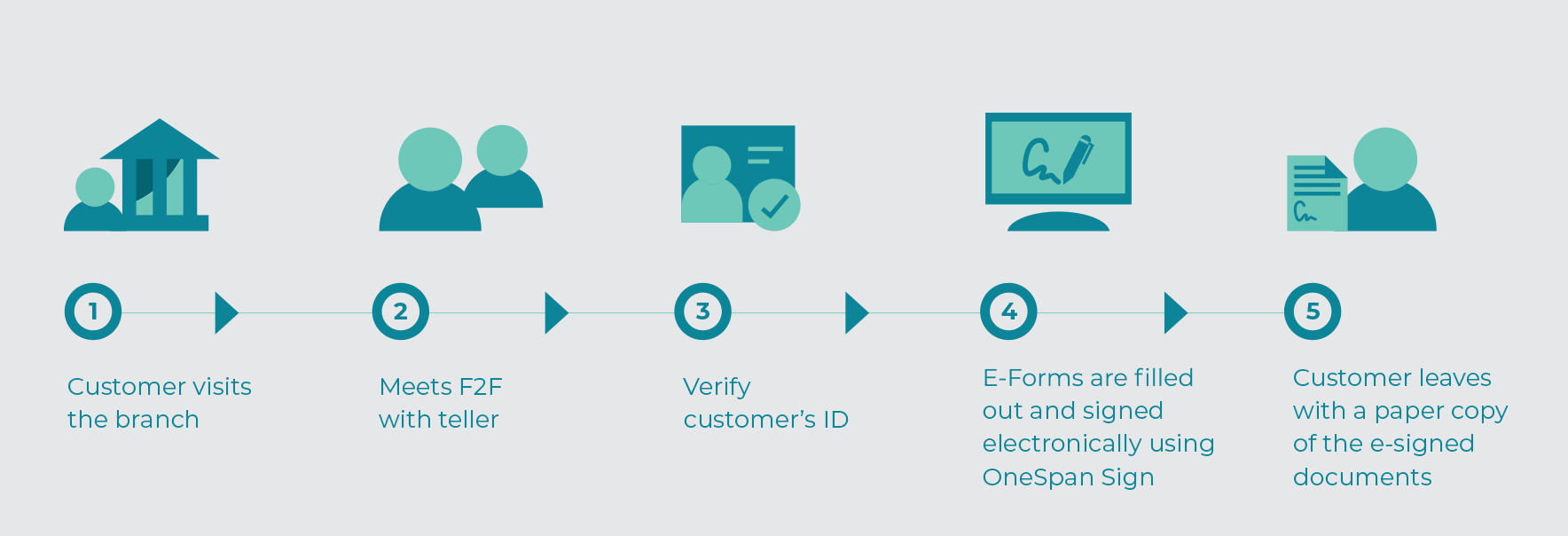

The fully electronic process

The Solution

To open an account or manage an existing account, customers still visit a branch. The teller authenticates the customer using a government-issued photo ID such as a driver’s license.

Directly through a Topaz tablet, the customer validates the spelling of their name, address, telephone number, social security number, and other personal data. The forms are e-signed on the signature capture pad and the customer clicks to accept disclosures (where applicable).

Instead of printing a signature card, the customer once again signs on the pad with a stylus. Their signature is automatically indexed and stored in an electronic archival system, and the customer leaves with a copy of the e-signed documents.

The integration with OneSpan Sign took no more than a few days. [...] By leveraging the technology we already had in the branches, our team saved close to 80% of the development time.

Integration

The bank’s account openings platform was integrated with OneSpan Sign Enterprise Plan. This enables the bank’s system to hand over the forms to OneSpan Sign. From there, OneSpan Sign takes over and executes the signature transaction through the tablet. This includes the presentation, population, review, acceptance, and signing of forms. Completed forms are then returned to the bank’s bank-end system for downstream processing and archiving.

Behind the scenes, the bank’s IT team was pleasantly surprised by how easy it was to extend the use of e-signatures to account openings. Two years prior, they had taken an enterprise approach and implemented the OneSpan Sign e-signature platform with the intention to scale out to other lines of business in the future. As a result, extending e-signatures to deposit accounts required significantly less effort than it would have if the bank’s various business lines had taken a siloed approach. Taking an enterprise approach meant there was no need to repeat any of the effort around vendor management, infrastructure, security or development. “By leveraging the technology we already had in the branches, our team saved close to 80% of that development time,” says a bank executive.

White paper

Rethink digital account opening for faster growth

Successfully onboarding a new customer on their first attempt accelerates time-to-revenue and customer loyalty. Learn best practices from peers who transformed digital account opening.

Read now